Institutional trading services from DASH Prime:

Brokerage and Execution

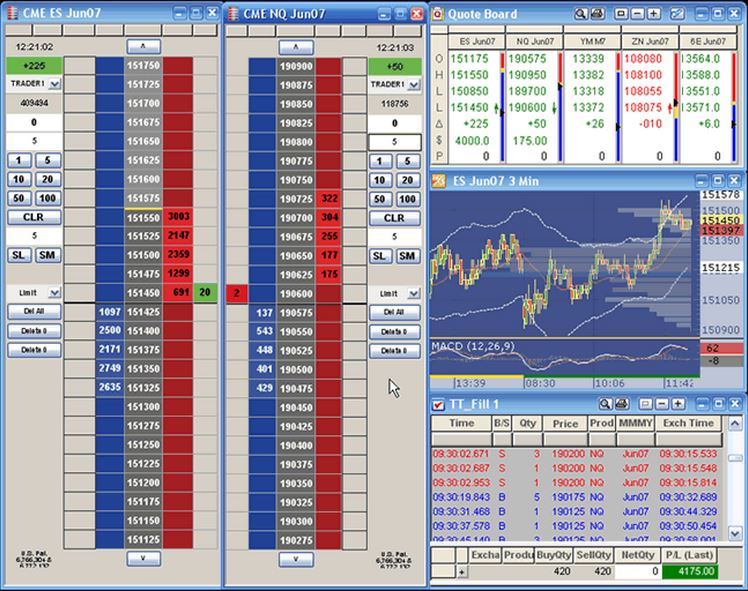

Multi-Asset Trading

Low Latency Platforms

Advanced Scanning Tools

Concierge Service

Cost Efficiency

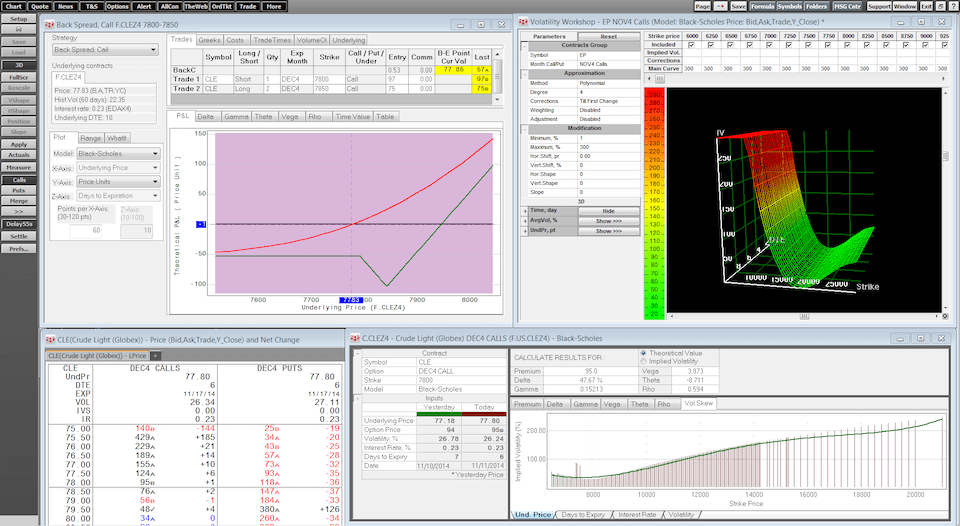

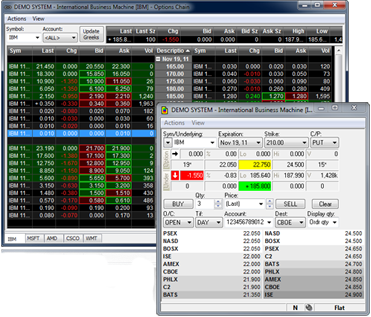

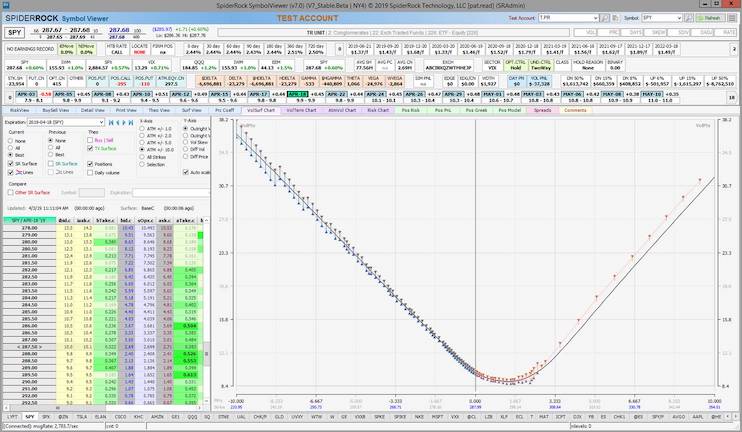

Trading Platforms for Options, Stocks and Futures

We know that no single trading platform can meet the needs of all our professional and institutional clients. This is why we offer connectivity to our OMS from many industry leading platforms for trading options, stocks, and futures. Choose the platform that provides the specific features you're looking for, or simply the platform with which you're already familiar.

These third-party options and stock trading platforms connect to DASH Prime's central order management and routing engine, providing a seamless routing, execution, and trade reporting experience.

Not sure which trading platform is best for you? Call us at 312-690-2500 and we’ll help you decide.

Brokerage Services

We are a FINRA, SIPC and NFA member agency-only introducing broker dealer supporting customer and institutional trading accounts. By not engaging in any proprietary trading (trading of Firm capital), we eliminate the potential for conflict of interest when it comes to executing customer trades. In order to ensure that our services remain aligned with the needs of our professional clientele, we require a minimum account size of $250,000.

Who We Serve

- Professional Traders

- Hedge Funds

- High Net Worth Individuals

- Institutions and Trading Groups

Account Types

- Portfolio Margin

- Prime Brokerage, DVP, RVP

- Pattern Day Trader, Reg-T

- Options, Equities, Futures

Clearing Options

- Our clearing agents include:

- Apex Clearing Corp (Equities and Options)

- Marex Capital Markets (Futures)

Execution Services

- We offer execution-only services for clients

- who wish to prime their accounts with other brokers.

- Utilize our institutional trade desk or electronic

market access infrastructure

Funding Requirements

- House Minimum - $100,000

- Portfolio Margin - $250,000

- Execution-only - No funding required

Pricing

- There are several factors which determine the

- commissions and fees we charge. Please call or email

- our client service group to discuss your specific

- account needs and our cost structure.

Technology

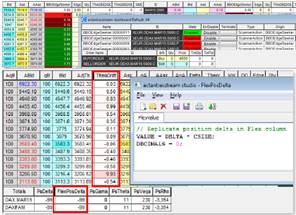

We recognize that professional traders require specialized tools in order to get a potential edge on the market and position themselves to generate alpha. Our technology product suite improves each step of your trade lifecycle by helping you identify trading opportunities, manage risk, maximize margin utilization, track portfolio performance, and manage fees.

We’ve developed a product suite that allows you to focus on trading.

Flexible Order Management System (OMS)

- Utilize your preferred trading platforms

- Link to your choice of exchanges, brokers and execution providers

- Consolidated order and execution management

The Finder

- Options data and trade opportunity scanner

- Built-in spread trader

Infrastructure

- Locate in and utilize our segregated office infrastructure

- Co-locate your servers in our data centers

Client Reporting

- Exchange fee management

- Order count manager

- Portfolio and trading fee analysis

- Historical data

Ready to get started?

Tell us which services you're interested in and we'll contact you with relevant information.

Our office

DASH Prime, LLC

200 South Wacker Drive

Suite 2400

Chicago, IL 60606

About DASH Prime

DASH Prime specializes in providing technology, execution and brokerage services to professional traders, hedge funds, high net worth individuals and institutions who trade the U.S. options, equities, and futures markets. We offer a low-latency order management system (OMS) that works seamlessly with a wide range of industry leading trading platforms and allows our clients to efficiently manage and route their order flow to any exchange or execution provider. Our real-time risk and margin application, along with market data and trading activity scanning tools, let traders identify trading opportunities while managing risk and maximizing leverage. Our web-based client reporting system provides access to account performance, trading history, order counts, exchange fee estimates as well as fee and cash management. We custom tailor our products and services to meet the specific needs of our professional trader clients, and we pride ourselves on the high-touch service provided by our experienced client support team.

DASH Prime is a SEC registered agency-only introducing broker dealer and is a member of FINRA, NFA and SIPC. We maintain clearing relationships with Apex Clearing Corp and Marex Capital Markets.